Initial Public Offerings (IPOs) are arguably the best short-term investments you can make in the stock market.

From 1980-2020, the average IPO popped almost 18.5% on the first day.

Last year, in the middle of the pandemic, you might not be surprised to learn that healthcare was the best performing sector in the IPO market.

But you might be surprised to learn those IPOs averaged 89% returns in less than a year!

Or that IPOs in all other sectors weren’t far behind — only a smidge lower, good for returns in the high-70s on average.

This year, IPOs have kept up the torrid pace — if not accelerating, as the economy begins to emerge from the covid clouds.

Consider…

- Legal Zoom (Nasdaq: LZ) is up 25%, less than a month after its debut

- Celebrated IPO Roblox (NYSE: RBLX) has advanced 69% since March

- And Esports Technologies (Nasdaq: EBET) has shot up a dizzying 268% since its IPO on tax day, April 15

And those companies aren’t even in the hottest sectors today — like healthcare and real estate!

Still — simply launching an IPO is not a guarantee the stock will do well. For every Esports, there are some soon-forgotten companies that fizzle on launch.

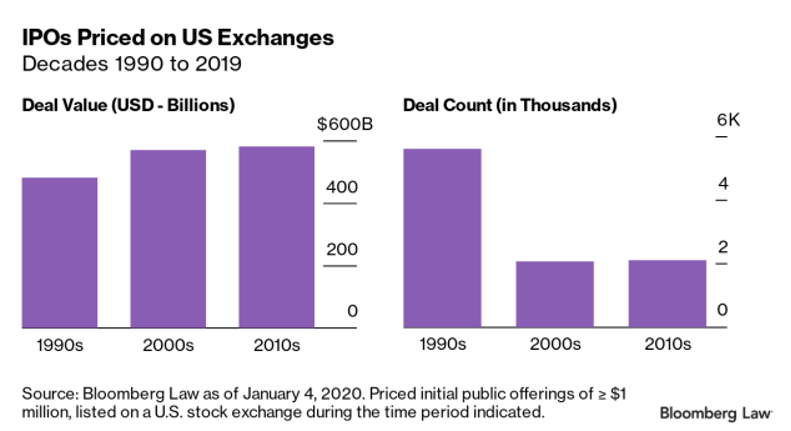

Making IPO investing even more difficult… while the size of the IPO market has held steady through the years, that value is being concentrated in fewer and fewer market launches.

What does that mean in practice?

Just as much money, being squeezed into fewer and fewer deals.

That means fewer swings at the plate… making it all the more important you choose the right IPOs to invest in.

And that doesn’t simply mean IPOs you’ve heard about.

After all, Robin Hood (Nasdaq: HOOD) had been a hotly anticipated IPO for awhile…

But then, with its recent controversies regarding halting the trading of “meme stocks,” many called it the worst IPO in history for a company of its size.

The share price has recovered a bit since then, but nonetheless — that’s not how you want to invest your money.

That’s why we’ve assembled the three IPOs we’re most excited for in the second half of 2021.

All should be tremendous opportunities for you to see outsized gains in an incredibly short period of time.

Let’s dig in.

2021 IPO #1: The EV Maker With Hook-Ups in All the Right Places

2021 has become the year of the electric vehicle. Tesla has blown past projections, and established itself as the most valuable car company in the world (more valuable than the next nine put together, actually).

- Every major manufacturer has unveiled its own entry into the EV field.

- Ford will invest $30 billion into EVs by 2025, and expects 40% of sales to be electric by 2030.

- By 2030, Mercedes Benz plans to only make electric vehicles.

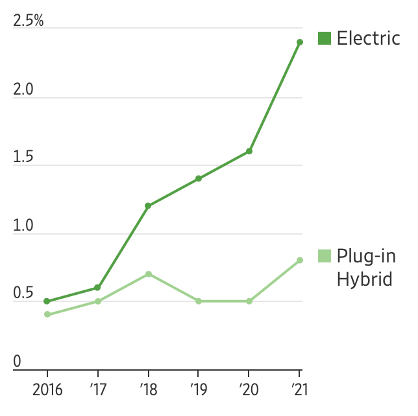

It’s not surprising that auto manufacturers are piling into the EV market. After all, while traditional combustion-engine vehicles have seen sales growth slow and sputter, EV sales have doubled in the past three years.

Still, you’ll notice that EVs only make up 2.5% of the overall market as of June 2021. To hit the goalposts manufacturers have set for themselves, EV sales will need to accelerate.

Whether that happens or not, there’s little doubt that EVs are one of the hottest sectors in the markets today.

And that’s why Rivian has one of the most hotly anticipated IPOs this year.

The company has not one, not two, but three EV models coming out this year, including a pickup truck and an EV.

It has secured over $10 billion in private financing, including from giants like Ford and Amazon, both of which own over 10% of the company.

Amazon has contracted Rivian to develop a fleet of electric delivery trucks.

Meanwhile, Ford is jointly developing a truck with Rivian — which is not included in the three models rolling out this year.

And Rivian has actively been looking for a spot for its second assembly plant — which will make batteries, as well as vehicles.

It’s estimated that Rivian will IPO at a valuation of around $70 billion, which would be over twice its valuation during its last private raise.

But don’t let that scare you. There are few companies in a better position to take advantage of the generational shift away from combustion and towards electric vehicles.

And there are no other IPOs anywhere near its league.

Rivian has already selected its IPO underwriters, so although no official date has been set, that is a mere formality. Most observers think it could come as soon as September.

It has often been said — quite rightly — that there are no guarantees when it comes to investing.

But Rivian experiencing a huge pop during its IPO is about as close as you can get.

2021 IPO #2: The Pandemic’s Latest Big Winner

Covid changed almost everything for almost all of us.

No going into the office (hello Zoom and Slack!)

No traveling for business, pleasure, or anything in between (goodbye airline valuations!)

It even changed the way most of us shop.

Online shopping exploded — up an eye-watering 44% last year.

That’s after multiple years of double-digit growth. But of course, nothing compares to lockdowns for spurring shopping-at-a-distance.

But there are some things that you can’t buy online — not really, at least not yet.

Groceries being perhaps the most important category.

That’s why last year so many people were introduced to Instacart.

If you aren’t familiar, Instacart is a shopping service that can give you same-day delivery from any of a number of local grocery stores.

Covid has supercharged Instacart’s growth.

In 2019, Instacart was losing $25 million a month, burning through cash in the hopes of establishing a dominant position within the grocery delivery industry.

By April of 2020, it was making $10 million a month — with more growth ahead.

Instacart had less than 100,000 shoppers in 2019. (Shoppers are those who do the shopping for buyers, not the buyers themselves).

In 2020, Instacart added 350,000 shoppers!

More than $35 billion worth of groceries were bought through Instacart.

And the growth hasn’t slowed down.

In fact, growth continues to be so robust, that Instacart has pushed back its planned IPO. Tentatively scheduled for the first half of the year, Instacart has decided to IPO late in 2021 — the better to prove its success is not a covid-fueled flash in the pan.

While we don’t have all the numbers yet — one of the privileges of being a private company — all indications are that opening up hasn’t put a dent in Instacart’s business, nor its valuation.

In March, Instacart had a fundraising round that valued the company at $39 billion, with investors like Fidelity, T. Rowe Price, and Andreesen Horowitz pouring in.

Indeed — the only possible problem with Instacart’s IPO is if they don’t IPO — and go with a direct listing instead.

In direct listings, no new shares are issued, because the company doesn’t need to raise any money. It simply puts existing shares into the public markets.

Should that happen, the initial bump should be even greater — since demand will be there, but shares will be in short supply.

So though it wouldn’t technically be an IPO, it would act the same as one… just with a little rocket fuel added to the mix.

2021 IPO #3: The Fintech That Scares the Banks

Once upon a time, banks seemed like some of the most solid institutions around.

My how times have changed.

The aura of invincibility was swept away by the housing and banking crisis of 2008 and 2009.

And though most banks survived that episode, they made a lot of enemies out of the common man. After all, fat multi-million dollar bonuses don’t look so good when you’ve nearly crashed the entire financial system, only saved by tax-sponsored bailouts.

But if banks thought they’d survived just fine — well, they may wind up having to eat those words.

Because a new generation of financial company has come around.

Companies that don’t have the baggage of the legacy banks.

Companies that can do everything banks can do — and do it cheaper at that.

Companies that are at least as trustworthy as the legacy banks — not because this new generation is exceptionally honest, but rather because the world has discovered how dishonest the previous generation is.

And, perhaps most important of all, this new generation is sleeker, more user-friendly, and built for the modern world.

Legacy banks have janky apps built overtop janky decades-old systems.

The new companies — they are apps. Apps that have eliminated most of the middle-man expenses that made up legacy banks’ bread and butter.

Apps like Chime.

Chime very specifically says it isn’t a bank.

And that’s true. It actually subcontracts out banking services to Bancorp.

But Chime is a one-stop shop for all your financial needs, under one roof. With low or no fees. With marketing aimed at millennials — currently the largest generation in America, and soon to be the richest, as more Boomers retire.

And Chime is positioned to be the biggest fintech IPO since Stripe debuted earlier this year.

Last September, Chime raised money with a round valuing the company at a bit over $14.5 billion.

Today, most analysts think the company will IPO later this year with a valuation of at least $30 billion.

With its focus on millennials, Chime is positioned to be one of the biggest, and fastest-growing, fintechs around.

With its hands in every pie — and a user base of over 12 million — Chime is ready to profit from any and every type of financial transaction.

And, with the legacy banks covered in blood, and startup competitors like Robin Hood inviting controversy, Chime is poised to become one of the most trusted names in the financial space.

In banking, trust is everything.

That’s why we trust Chime will have one of the best IPOs this year — perhaps even rivalling Stripe when all is said and done.

RESTRICTED for 82 years…

Sponsored

One type of investment has created some of the greatest fortunes the world has ever seen…

Like those of multi-billionaires Elon Musk, Jeff Bezos, Peter Thiel, and Mark Cuban.

Unfortunately, most Americans know nothing about it.

And even if you did… you were LOCKED OUT for 82 years!

But now, the doors have been flung wide open…

And one man is revealing everything about this previously restricted investment.

His name is Matt Milner. And in this shocking exposé, he’ll show you:

- How Wall Street has been keeping these investments hidden from ordinary investors…

- The back-room dealings, where insiders and early investors are cashing out at the expense of mom-and-pop investors…

- And the secret “Cheat Codes” that can get ordinary investors into the most potentially lucrative investments out there.

If overvalued stocks, risky options, or cryptocurrency trades seem like pure mania to you…

Like picking up pennies in front of a steamroller…

You’ll want to watch this interview with Matt Milner right now.

But as Matt explains right here, each day that passes represents another missed opportunity…

(An opportunity to pocket a potential life-changing fortune.)