The global recovery faces increased pressure as the Omicron mutation continues to spread…

In an interview with CNBC’s “Street Signs Asia,” Moody’s managing director of creditor services and research, Atsi Sheth, said emerging markets will likely continue to struggle compared with more advanced economies.

This is particularly true for areas with disappointing vaccination rates due to the recent rise of the Omicron COVID-19 variant. While many parts of the world have begun to rebound, their recoveries have remained in a fragile place – as demand has yet to return to pre-pandemic levels.

Couple this with monetary policies tightening worldwide, and many countries are beginning to report even greater pressure on economic demand.

Even so, she explained that there is a great deal of variation depending on the market – with parts of Asia reporting stronger performances than others.

This could be a bullish sign for this one Chinese stock – particularly now that Beijing’s regulatory crackdown is coming to an end…

Former CIA Advisor: “They are LYING about inflation!”

Despite the circus of distractions you’re hearing on the news… The lies and the misdirections… There’s one former CIA and Pentagon insider revealing the TRUTH behind the inflation numbers in America. A story so shocking and so powerful that it could bring the Biden Administration to its knees. You might have known something strange was going on in America, but I can guarantee you weren’t expecting this.

Click here to see the story the mainstream news is trying to bury.

And JD.com (JD) could be among the biggest benefactors of the Asian market’s economic improvements.

Even though competitor Alibaba (BABA) has long-dominated the e-commerce market, JD has rapidly expanded its business.

This has helped it grow its digital-retail market share to about 28%. It has also allowed it to become the primary platform Chinese consumers use to purchase high-quality products.

And while others were weighed down by China’s new regulations, JD thrived. That’s because prior to the new guidelines, Alibaba had several merchants locked in with exclusivity agreements.

But with the changes, Alibaba’s monopolistic deals were forced to end – helping JD add several popular merchants to its e-commerce services.

And with economic activity quickly improving in the region, consumers may have even greater excess cash to spend on products moving forward.

As a result, many may turn to JD as their platform of choice – offering the company major tailwinds as the country continues to rebound at a faster pace than other global markets.

Where to invest $25 right now…

And no it isn’t JD…

Brownstone Research

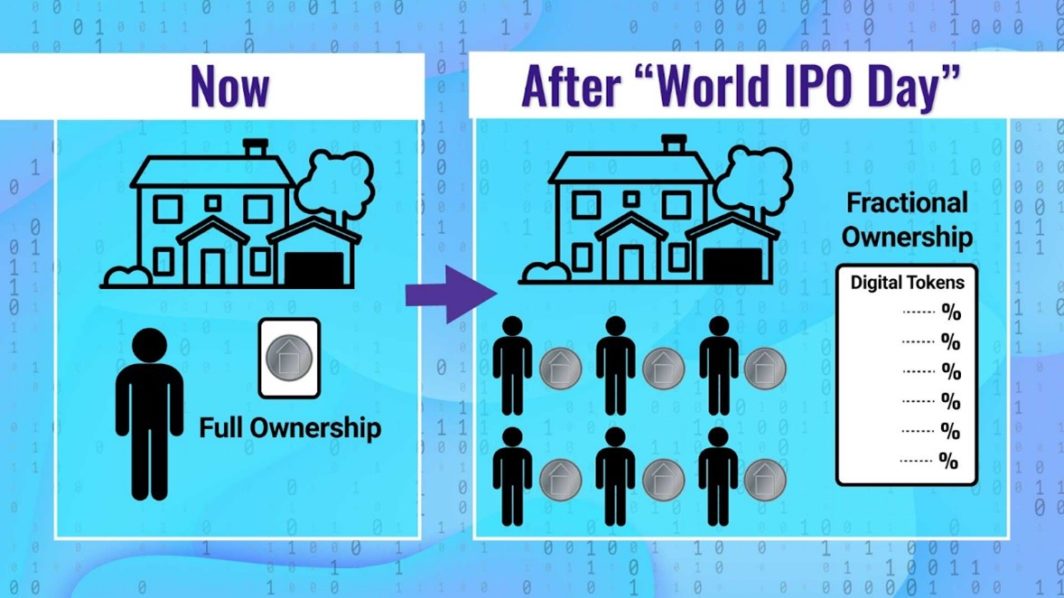

7 out of 10 of the world’s largest banks publicly announced they’re working on tokenization.

The Chairman of the S.E.C. says “Door wide open to tokenization.”

And according to tech legend Jeff Brown, it will take:

“Real estate, art, collectible cars, jewelry, and gemstones…

…and turn them into digital tokens.”