JPMorgan Chase & Co (JPM) is a New York-based financial services company.

In July, JPM reported second-quarter earnings per share of $3.03 compared to the anticipated $3.20. Revenue was $31.4 billion, greater than the expected $29.94 billion.

JPM decreased its loan-loss provisions for the third-straight quarter as well. At the onset of the pandemic, the company had set aside billions in the instance that customers couldn’t pay off their loans.

This resulted in $34 billion in reserves. However, since then, the financial services company has cut down its provisions to $22 billion, suggesting improvements in economic activity.

But in more recent weeks, JPM also revealed that exchange-traded funds had reached $9 trillion in asset value. This prompted the company to announce that it would convert four active mutual funds, with $10 billion in assets under management, into ETFs.

Because of these factors, investment advisory company Credit Suisse maintained its outperform rating for JPM shares. Credit Suisse also increased its price target from $170 to $177 – adding that improving economic conditions should prove to be a tailwind for the company’s revenue moving forward.

So, as economic activity continues to rebound, consumer spending will also rise. In turn, more people may grow increasingly comfortable with investing their money and relying on investment banks like JPM.

[PROOF] Bezos DUMPING Amazon shares to buy into VLEO? Get in NOW, before his next investment…

Sponsored

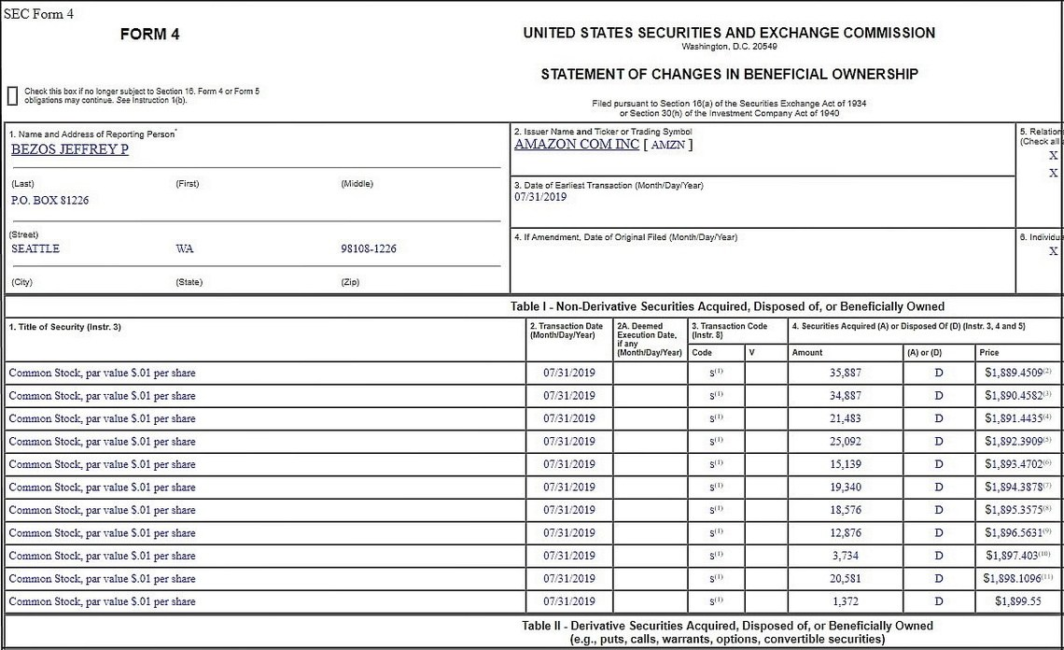

Take a look at this SEC filing for Amazon Founder Jeff Bezos:

That’s over $1.8 BILLION in Amazon shares sold off in only 3 days by Bezos.

Is Amazon going under? Did he want a couple new mansions?

I can’t say for sure what he did after this specific sale, but this quote from Bezos himself could be the smoking gun…

“My business model right now … I sell about $1 billion of Amazonstock a year and I use it to invest in [THIS]” – Jeff Bezos

That’s right, Jeff Bezos is selling $1 billion in Amazon stock each year to support a new venture.

And Jeff Bezos isn’t the only one who’s betting BIG on this…

Elon Musk is investing $10 billion…

And even the U.S. Government has earmarked $9.2 billion for it.

This story is developing rapidly…

And if my research on VLEO is correct…

Fast-moving investors could start to take home a fortune as soon as September 7th, 2021.