Robotics stocks offer an attractive source of opportunities for growth investors.

The long-term potential of the industry is obvious.

For over a decade, investors have been rewarded for focusing on growth tech names instead of value stocks.

As long as that trend holds, robotics stocks should be winners.

Whether it’s healthcare, defense or heavy industry, automation and robotics are changing the world.

Savvy investors will look for exposure to that transformation.

So, here’s my No. 1 robotics stock to buy and hold now…

ABB Ltd (NYSE: ABB)

Since its inception in 1987, ABB Ltd (NYSE: ABB) has been an industry leader in the robotics field.

ABB is committed to helping the industry grow through the usage of its automated robotics line.

In fact, it’s the number-two automated robotic arm supplier in the world.

In automation, ABB offers a full suite of products that help its clients build everything from ventilators to cars on an assembly line with robots.

Even in the earliest days of ABB, the technology it created generated enormous rewards for visionaries who were quick to switch from costly and unpredictable manual labor automation to more predictable and cost-effective robotic assembly line automation.

The company’s line of automatic spot-welding robots designed and installed in various US car manufacturing factories in the early 90’s helped the industry boom here in the states and allowed early investors to quickly generate a strong return on investment.

Back then, it would take a day or two to assemble an entire car with human manual labor. But it would only take hours with the help of ABB’s robotic arms.

Fast forward to today, with major advances in the company’s technology over the last three decades, and ABB is working on a project to assemble an entire car in 46 seconds with its proprietary automated robotic arms.

ABB has expanded its business rapidly over the years. Today, its products are in over 50 countries with more than 400,000 robots installed globally.

And there’s good reason to believe it’s only going to continue growing as more companies see the benefit of using robots over humans to create their products…

You see, ABB plans for major expansions in the near future, especially in the Asian market – which is widely expected to be the No. 1 robotics market over the next decade.

ABB understands that the “factory of the future” is actually possibly with today’s technology. And I think it will dominate the robotics industry for years to come.

Most importantly, the stock is currently priced for you to reap the benefits from a long-term investment starting today.

[finviz ticker=ABB]ABB is currently trading for $30.50.

But I think it could reasonably double over the next year or two as the company increases its robotic workforce over the same timeframe.

Google Just Poured $4 Billion Into THIS…

Sponsored

The world’s most successful tech industry giants are all clamoring to get their hands on a new piece of technology.

It’s fresh out of a highly secretive lab in Boston, Massachusetts, and it’s poised to make early investors billions.

It’s NOT cannabis. It’s NOT bitcoin, or some other blockchain-related technology. It’s NOT 5G.

And as a matter of fact, it could be bigger than all of those. Because if history is any indicator, you could be looking down the barrel of 5,000% profits… or even more.

Companies all over the world are funneling as much money as they can into what Bill Gates calls, “the holy grail” of modern technology.

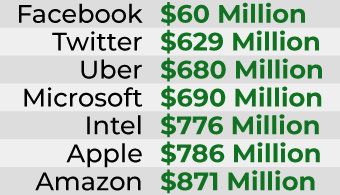

Take a look at some of the top contenders and their spending history:

But Google takes the cake by a landslide. They’ve poured more than $3.9 BILLION into this mind-blowing new tech that’s taking the world by storm.

Click here to see this brand new tech in action, and find out how it could make you 10… 20… even 50 times your money.