Countries worldwide imposed new travel restrictions following the discovery of yet another COVID-19 variant.

Both the U.S. and European Union (EU) recently announced that they have blocked arrivals from seven southern African nations. These countries include South Africa, Botswana, and Namibia.

Meanwhile, places like Austria and Slovakia have established national lockdowns. And the Netherlands and Belgium implemented fresh restrictions as well.

This has many watching the market concerned about the travel industry’s broader recovery. However, the situation may not be as dire as some headlines would make you think.

While the Omicron mutation is weighing on international travel, hotel bookings, and passenger traffic, its disruptions could be short lived.

That’s because recent studies have shown that even though it spreads more rapidly than the Delta variant, the associated infection is less severe.

Meanwhile, White House health chief Dr. Anthony Fauci said further data shows that existing vaccine boosters are more than enough to help protect individuals from severe disease.

Yet, moving beyond the health-related factors, the President said that the U.S. is unlikely to impose additional travel restrictions due to the Omicron strain.

And if the situation pans out the way many experts and leaders anticipate, this could provide some good news to recently beaten-down travel stocks, like this one…

These Tiny “Penny Coins” Are Crushing Bitcoin

Most people have never heard of these tiny coins. In fact, they sell for a piddly fraction… pennies on the dollar… compared to the five-digit price tag that just ONE Bitcoin costs. Yet they are quickly racking up some of the biggest gains we’ve ever seen anywhere – beating the gains in the stock market and gold market. Heck, they’re even crushing gains made by Bitcoin – by 75X, 211X, even 5,567X more in the same six-month time frame. It’s a revolution in the making. Go here to see these coins.

This includes Vail Resorts (MTN). This company is an American resort operator with facilities in North America as well as Australia.

In its most recent first quarter, Vail reported a loss per share of $3.44 versus the expected $3.62. The company also reported revenue of $175.6 million, below Wall Street’s forecast of $192.7 million.

But while this seems like a negative, its overall sales surged by 21% versus the same period last year. This is especially impressive considering its winter resorts are typically closed in the first quarter.

These factors indicate that even though the Delta and Omicron variants have put increased pressure on broader travel numbers, many consumers are continuing to opt for more leisurely trips following last year’s lockdowns and restrictions.

And with reports showing Omicron infections may be milder than initially feared, we could see overall travel confidence improve moving forward. If this happens, it will benefit broader travel numbers as well as lodging demand over the winter holiday season.

Where to invest $1,000 right now…

Before you consider buying MTN, you’ll want to see this.

Investing legend, Whitney Tilson just revealed his #1 stock for 2021…

And it’s not MTN.

He bought Netflix at $7.78, Apple at $1.42, Amazon at $48 and Now he’s going all-in on the one stock driving the next big tech trend that will make investors rich in 2021.

You can learn all about it on Mr. Tilson’s Website, here.

Wondering what stock he’s investing in?

Click here to watch or read his presentation, and learn for yourself…

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream… And by then, it could be too late.

Click here to find out the name and ticker of Whitney Tilson’s no. 1 pick for 2021…

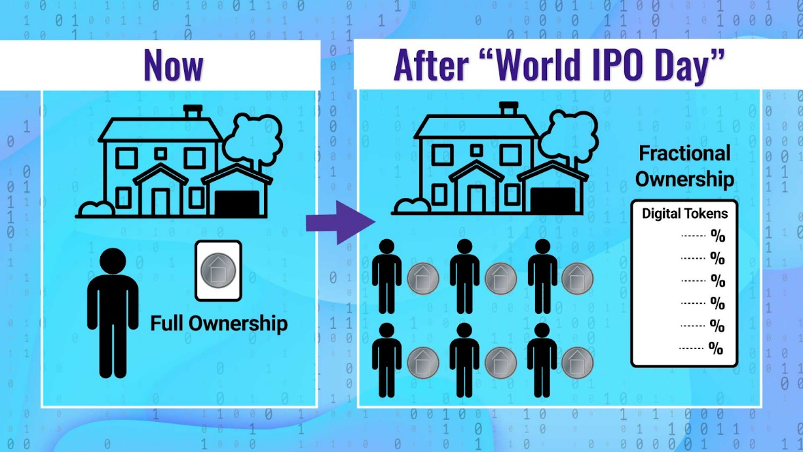

New “World I.P.O. Day” Investing Broadcast Alert

Legacy Research

7 out of 10 of the world’s largest banks publicly announced they’re working on tokenization.

The Chairman of the S.E.C. says “Door wide open to tokenization.”

And according to tech legend Jeff Brown, it will take:

“Real estate, art, collectible cars, jewelry, and gemstones…

…and turn them into digital tokens.”