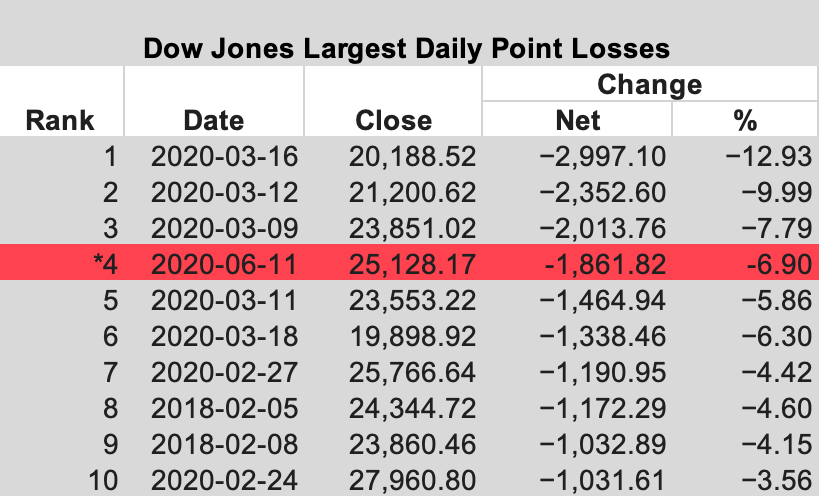

If last Thursday’s (June 11) 6.9% stock market plunge wasn’t enough to help you realize that volatile times are still ahead, I don’t know what will.

The 1,861.82 point-drop was the fourth largest in the 124-year history of the Dow Jones Industrial Average.

In fact, seven of the largest 1-day point drops in history have occurred this year…

And with futures dipping more than 800 points at one point this morning, the Dow is pointing toward yet another blood-red day in the stock market.

Without a vaccine that can be widely distributed, the coronavirus is still clearly a threat to society, economic behavior, and thus corporate profits.

If cases continue rising in states that have reopened their economies, local governments could rush to yet another lockdown.

That would force investors to sell stocks they think have worse diminishing chances of generating revenue with people cooped up in their homes.

Airlines, cruise lines, and retail stores are some of the most obvious industries that are going to be most affected.

But today, I’m going to reveal some not-so-obvious stocks to sell… And what to do instead. You may want to double check your portfolio and make sure you don’t own any of these companies…

SmileDirectClub Inc. (NASDAQ: SDC)

Since the day SmileDirectClub went public on Sept. 3, 2019 for $23 per share, it has been one of the worst performing stocks on the market.

To date, SDC is down 68%. For perspective, the S&P 500 is up 4.7% over the same timeframe.

The concept of the business is brilliant: Make it affordable and convenient for people to transform their smiles.

Instead of visiting the orthodontist once a month time to adjust your braces, SmileDirectClub will mail you clear mouthguards that gradually alight your teeth for about 1/3 of the average dentist cost.

But the underlying market fundamentals are screaming it’s unsustainable over the long-run.

You see, SmileDirectClub has never turned a profit in the six-year history of the company.

In fact, losses are increasing at a worrisome pace…

In 2017, the business lost $37.8 million. By the end of fiscal 2019, those losses increased 203% to $114.5 million.

And I think those losses could conservatively double in 2020 if the unemployment rate remains high due to the coronavirus…

That’s because people have to prioritize paying their mortgage/rent, putting food on the table, and other necessities before splurging a couple thousand dollars on straightening their teeth.

If SmileDirectClub doesn’t figure out a way to decrease costs and increase profits soon, it could soon find itself in the same position as our next stock: filing for bankruptcy.

Hertz Global Holdings Inc. (NYSE: HTZ)

There is absolutely no reason to own Hertz right now.

Your neighbor may have doubled or tripled their money with Hertz last week, but don’t let that distract you from your long-term goals.

This stock is going to zero and all shareholders will be wiped out eventually.

What happened with Hertz last week was an anomaly. It’s not investing, it’s gambling.

You see, without sports to bet on and many parts of the economy still shut down, millions of people have opened up brokerage accounts and started trading penny stocks with the hopes of making fast profits.

That may have worked out for a small percentage of Hertz gamblers last week, but don’t expect it to happen again.

Last Friday, a bankruptcy court approved Hertz’s request to sell up to $1 billion in stock after this wave of speculation flooded the market and caused the stock to rise from $0.82 to $5.54 in just 3 trading sessions.

I’m not sure how that’s even legal seeing as the company is still heading towards bankruptcy, the stock is almost certainly going to zero, and the current market cap is only $400 million.

But regardless of those recent highs, HTZ has already dropped like a rock – down 52% to $2.65 per share.

Stay away from this stock at all costs.

Aurora Cannabis Inc. (NYSE: ACB)

Our last stock to avoid now is Aurora Cannabis.

Short sellers have had a field day with cannabis stocks in 2019 and 2020 after the massive bull market in 2018…

Down 90% from its 2018 highs, Aurora has been one of the hardest hit companies in the sector.

But don’t get sucked into a “value trap” with this company.

Earlier this year, Aurora shares traded as low as 60 cents from a combination of a low cash balance, a persistently high cash burn rate, and a difficult outlook for raising new capital.

The situation was so dire that the firm had to implement a reverse stock split to maintain its public listing. It also announced a $250 million equity facility that could dilute shareholders by 30%.

Long-term, I do believe it’s only a matter of time before cannabis is federally legal nationwide. And cannabis stocks will certainly be worth more than they are today as a result.

But that time is not now. And it’s probably not even on the horizon for the next five years…

Don’t get me wrong, it’s wonderful to see cannabis stores operating as essential businesses during this pandemic while still being labeled a “Schedule 1” drug by the Federal government.

But at the same time, our country is dealing much more important problems at the moment. And legalizing cannabis just isn’t a priority right now.

20 years from now I’m sure cannabis stocks will be worth much more than they are today. But with all the money Aurora Cannabis is burning and only losses to show for it, I don’t expect this business to last another three to five more years…

Actions You Can Take Right Now

First, double check your stock portfolio and make sure you don’t own any of the companies listed above.

And please read the following urgent warning from a former CIA and Pentagon advisor…

Former CIA and Pentagon Advisor: “Millions of Americans are in DANGER!”

America could be facing a catastrophe that will catch most people by surprise…

And no, it’s not the coronavirus.

But this historical event will change America forever.

Most Americans have no idea what’s about to hit them in the coming days.

Which is why I’m urging Americans to take these 5 steps right now.

Click here to see them. (Hint: one of these steps could protect the lives of your loved ones)