5G is coming to America soon.

With internet speeds up to 100 times faster than 4G, 5G will increase our productivity here in the United States by 18x.

And it’s projected to add $13.2 trillion to the U.S. economy by 2035.

The best part is, we’re in the early stages of this technological revolution. So, you can still invest on the ground floor today…

See, the infrastructure for 5G hasn’t even been fully built out yet.

In order to generate the insane processing speeds, thousands of new cell phone towers still need to be constructed.

And every major telecommunications provider, like Verizon, AT&T, T-Mobile, Comcast, and even the Department of Defense will all have to pay the firms that build and manage these cell towers rent every month.

That’s my favorite way to profit in the 5G space today.

Investing in a 5G REIT is like owning a tollbooth that major corporations have to pay a fee to use every time one of their customers connect to one of the cell towers you own…

And since it’s structured as a REIT (real estate investment trust), the company is legally required to pay out at least 90% of their taxable income as dividends to shareholders.

Here is my favorite 5G REIT to buy and hold for the long-term…

American Tower Corp. (NYSE: AMT)

[finviz ticker=AMT]Founded in 1995, American Tower Corp. owns and operates roughly 180,000 cell towers throughout the U.S., Asia, Latin America, Europe, and the Middle East.

The company leases space on its towers to wireless service providers, which install equipment on the towers to support their 4G and 5G wireless networks.

AMT operates more than 40,000 towers in the U.S., which accounted for more than half of its total revenue in 2019.

Its largest customers include AT&T (16% of revenue), Verizon (15%), Spring (9%), and T-Mobile (9%).

Outside the U.S., American Tower’s greatest presence is in India and Brazil, where it operates roughly 75,000 and 19,000 towers, respectively.

AMT is one of the leaders in new 5G towers being constructed today and it’s very profitable.

From fiscal 2018 to 2019, the firm increased its net income by 53% and the stock rose 63%.

So far in 2020, AMT stock is up 12.5% and I think it could reasonably increase another 20-30% by the end of the year.

Then, it could increase 40-50% per year starting in 2021 as 5G really starts taking off.

All the while, you can collect a 1.6% annual dividend yield just for buying and holding the stock today.

Tiny firm set to win race to deploy 5G

Content Sponsored By: Angel Publishing

We’ve all heard about investing in 5G.

But while everyone is talking about the fancy new 5G chips or antennas…

Nobody’s talking about the most significant piece of the 5G puzzle…

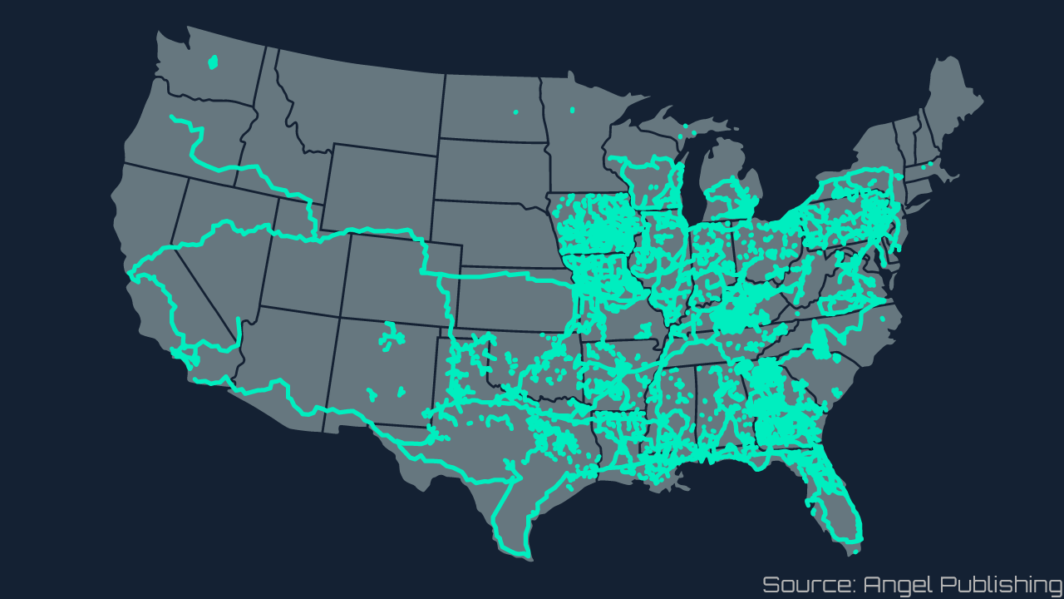

The web of networking cables crisscrossing the country that will bring information from all over the world right to your fingertips.

This is the backbone of America’s 5G network.

It simply can’t be built without those fiber-optic connections.

And there’s one company that literally owns this entire fiber network.

All of the wireless carriers and pretty much every big name in communication already have contracts in place with this company.

In fact, the ONLY cities in the entire country with 5G coverage are located right on this company’s fiber network.

Even the U.S. government is paying to get its secured communications on this critical piece of infrastructure.

Quite simply: This company owns more fiber networks than anyone else in America.

It is the critical piece for winning the race to deploy 5G.

And best of all, this company’s stock is trading around $10 a share.

But according to my research, you could be sitting on more than 600% profits after all’s said and done.

This company is leading the charge to 5G and could make early investors filthy rich.