Intel (INTC) is a semiconductor company that essentially creates chips that almost every kind of technology in the world relies on to function.

In the company’s most recent quarter, Intel reported earnings per share were $1.39 compared to the expected $1.15. Revenue was $18.6 billion versus the anticipated $17.79 billion.

Intel also predicted that its full-year 2021 earnings per share would be $4.60 compared to its prior guidance of $4.55. Meanwhile, revenue is poised to be about $72.5 billion, greater than its previous outlook of $72 billion.

And while the company has recently benefited from the supply and demand imbalance brought on by the global chip shortage, it has plenty of growth tailwinds ahead.

That’s because Intel is a major player in the cloud computing, data center, and smartphone industries. All of these sectors are becoming increasingly reliant on the latest semiconductors to even handle the sheer amount of data and speed that 5G will bring to the table.

And to capitalize on emerging trends, as well as alleviate some of the world’s semiconductor supply woes, Intel will invest $20 billion to build new chip fabrication plants over the next several years. This means it’ll not only build its own specialized semiconductors but also become a third-party fabricator for other businesses in a high-demand market.

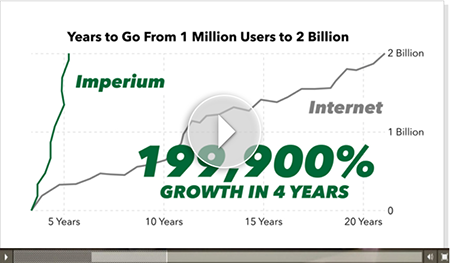

“IMPERIUM:” The No. 1 Investment of the 2020s

Sponsored

Could this odd-looking machine really be the most transformative innovation in history?

Experts are screaming: “YES”!

Elon Musk calls it “amazing…”

A former Apple CEO says: “[It will] have a far bigger impact on humanity than the Internet.”

While a Harvard Ph.D. says it could “[surpass] the space, atomic, and electronic revolutions in its significance.”

It’s a technology I call “Imperium.”

And it’s about to spark the biggest investment mega trend in history… with one small Silicon Valley company at the center of it all.

To get all the details, click here now…