The fifth generation of wireless infrastructure “5G” may be the biggest technological advancement since the dawning of the internet. Some benchmarks have shown the technology can produce speeds up to 100 times current 4G networks.

And it’s only just beginning…

Companies such as Apple (NASDAQ: AAPL) and Alphabet (NASDAQ: GOOGL) have begun to release 5G-capable mobile devices. Chipmakers like Intel (NASDAQ: INTC) and Qualcomm (NASDAQ: QCOM) are developing semiconductors to make these devices work.

Meanwhile, telecommunication companies Verizon (NYSE: VZ) and AT&T (NYSE: T) are continuing to expand on and develop networks to help consumers take advantage of 5G’s insane speeds.

However, even though the world continues to make strides to bring 5G to as many people as possible, much of the world still lacks the fundamental infrastructure required to make it all work.

That’s where some of the best 5G tower stocks come into play. These companies will be the ones building out cell towers and base stations for major service suppliers.

And they’re poised to play a pivotal role in the coming revolution for years to come…

That’s why I’m bringing you the first 5G tower stock I’m buying for 2021 that'll help you take advantage of this insanely lucrative trend…

One of the Best 5G Tower Stocks on the Market

T-Mobile (NASDAQ: TMUS) may not be a ‘hidden play’ on the 5G market, but this telecommunications and 5G tower company has the largest 5G network in the U.S.

In fact, the company’s 5G towers and network provide coverage to more than 250 million people over 1.3 million square miles. That’s more coverage than Verizon and AT&T combined.

In the regions where T-Mobile has built towers, it can deliver download speeds between 300 megabits-per-second and 1,000 megabits-per-second. The average download speed for current 4G networks is just 30 megabits-per-second.

And the company’s recent merger with Sprint should help to further bolster the company’s 5G footprint. Though, other major investments in the technology are already starting to pay off for the company…

In T-Mobile’s third-quarter report, the company said its earnings per share came in at $1 versus Wall Street’s expected EPS of $0.46. The company’s earnings before interest, taxes, depreciation, and amortization were $713 billion, beating the anticipated EBITDA of $6.19 billion.

T-Mobile’s revenue also crushed estimates at $19.27 billion compared to the predicted revenue of $18.3 billion. During the quarter, it added over 2 million customers, putting T-mobile’s current number just over 100 million.

This has given the telecom and 5G tower company the confidence to increase its guidance for the second half of 2020. EBITDA for the last six months is poised to come in at around $13.6 billion to $13.7 billion versus its prior guidance of $12.4 billion to $12.7 billion. Given the fact that the company already achieved its customer-growth goal, T-Mobile anticipates adding 1.3 million to 1.4 million more.

T-Mobile’s shares have surged 76.8% since its March lows thanks to its 5G initiatives. But even greater growth may still be ahead…

As consumers continue to buy the latest mobile devices, stream their favorite shows, and play online video games, companies like T-Mobile will remain pivotal in providing the 5G speeds to make it all work as efficiently as possible.

UPSET ALERT: Tiny Firm Set to Win Race to Deploy 5G

Sponsored

Nobody’s talking about the most significant piece of the 5G puzzle…

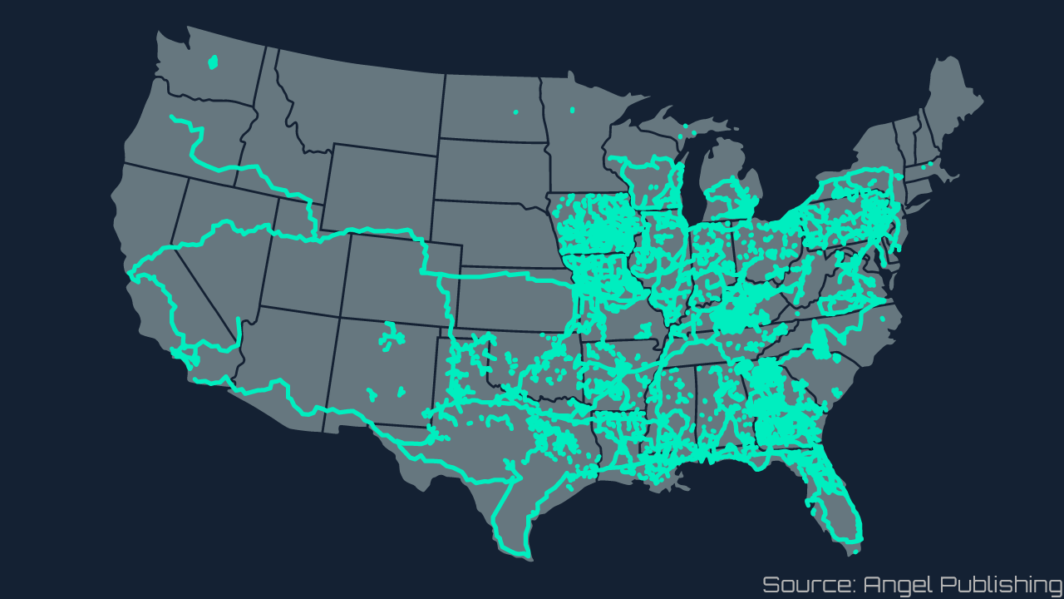

The web of networking cables crisscrossing the country that will bring information from all over the world right to your fingertips.

This is the backbone of America’s 5G network.

It simply can’t be built without those fiber-optic connections.

And there’s one company that literally owns this entire fiber network.

All of the wireless carriers and pretty much every big name in communication already have contracts in place with this company.

In fact, the ONLY cities in the entire country with 5G coverage are located right on this company’s fiber network.

Even the U.S. government is paying to get its secured communications on this critical piece of infrastructure.

Quite simply: This company owns more fiber networks than anyone else in America.

It is the critical piece for winning the race to deploy 5G.

And best of all, this company’s stock is trading around $10 a share.

But according to Brit Ryle's research, you could be sitting on more than 600% profits after all’s said and done.

This company is leading the charge to 5G and could make early investors filthy rich.